While the Bank itself bears the bulk of the responsibility for its own demise, in this article we are going to look at the multiple factors leading to the collapse of Silicon Valley Bank.

Formed in 1983, Silicon Valley Bank (SVB) was founded to provide financial services to startups, venture capitalists, and technology companies. At the time, the banking industry was not friendly to the needs of startups as many lacked revenues and the banking industry viewed startups as too risky.

Silicon Valley Bank understood these risks and managed them effectively early on through several methods. The first thing they did was include a well-connected Venture Capitalist (VC) on its board early on. This opened a close working relationship within the VC world. They would then collect deposits from businesses that were financed through these VCs. Some additional key risk reduction steps SVB took early on were:

- They required a pledge of half of a startup’s shares as collateral (Reduced later to seven percent).

- The startups tended to pay off the loans to retain control of the business which reduced losses.

- SVB further reduced losses by selling these shares to investors.

- They introduced startups to their own extensive network of VCs, lawyers, and accountants.

- They also prioritized lending to clients of top-tier VC firms.

Why is this important? It shows that the bank did understand certain key risks and managed them effectively early on. But positions, markets, economies, and risks change. Here are the multiple factors that led to the collapse of Silicon Valley Bank.

Internal Mismanagement

The first, and most significant impact was from internal mismanagement at SVB. The bank’s leadership failed to implement effective risk management policies, which led to poor lending decisions. SVB relied heavily on the technology industry, which made it vulnerable to market fluctuations. Additionally, the bank’s executives were accused of fostering a toxic work culture that led to high employee turnover.

There was a failure of good succession planning. The Chief Risk Officer Laura Izurieta exited the company in April of 2022. Though she stayed on as a consultant, the CRO position was left unfilled for eight months. During her tenure, she oversaw the purchase of the bond-buying spree that led to the collapse. After the exit the risk committee doubled its meetings to 18, suggesting concern and knowledge of the bank’s position.

Additionally, the head of financial risk management for the UK branch of SVB, Jay Eraspah focused on multiple “woke” LGBTQ+ agendas even as the bank faced collapse.

Furthermore, the internal audit department was understaffed and unable to identify potential risks. The bank’s IT infrastructure was outdated, and the management failed to invest in upgrading it. This lack of investment made it easier for cybercriminals to penetrate the bank’s systems and steal sensitive information. SVB customers were deluged with scams during the collapse.

Finally, SVB’s leadership ignored warning signs about the bank’s financial health, such as a decline in profits and an increase in loan defaults.

Lack of Customer Service

The bank’s lack of customer service was a significant factor in its collapse. The bank was known for its focus on startups and venture capital, which led to a lack of attention to other types of customers.

Many customers felt that the bank was not providing enough support and services, leading to a decline in customer satisfaction and loyalty.

The bank’s lack of customer service was seen as a reflection of its culture and values, leading to a loss of customer confidence and further increased scrutiny from regulators.

Economic Factors

Silicon Valley Bank faced several economic challenges including the rapid rising of interest rates. The economic environment over the last couple of years played a significant role in SVB’s collapse. The bank’s heavy reliance on the tech industry made it vulnerable to market fluctuations. When the COVID-19 pandemic hit, the tech industry was not immune to the economic fallout. Many startups and tech companies struggled to survive, leading to a sharp decline in SVB’s loan portfolio.

Additionally, the low-interest-rate environment made it challenging for the bank to generate income. SVB relied heavily on interest income from loans, and the low rates made it difficult to achieve profitability.

SVB heavily invested in bonds to take advantage of the higher interest rates as income fell from loans. Their intention was to hold the bonds until maturity. As the fed increased interest rates, the bonds decreased in value. SVB had to sell bonds at a significant loss.

Finally, the bank’s exposure to the cryptocurrency industry proved to be a significant risk. The highly volatile nature of the crypto market led to significant losses for SVB.

Loan Losses and Declining Profits

Since SVB had a heavy focus on risk investments particularly startups and venture capital projects, many of SVB’s loans went to companies that were not credit-worthy. These startups were largely vulnerable to market downturns and volatility.

The bank was heavily impacted by the 2008 financial crisis, which led to a decrease in lending opportunities and an increase in non-performing loans.

Additionally, the bank was impacted by global economic factors, such as Brexit and the US-China trade war. These factors contributed to the bank’s decline and ultimate collapse.

Business executives can learn from Silicon Valley Bank’s experience by ensuring their company is prepared for economic downturns and global economic factors.

Again, with a heavy reliance on customers in the tech industry in 2020 SVB had trouble again when the tech industry experienced a downturn. The bank’s profits declined even further, leading to a loss of investor confidence and increased scrutiny from regulators.

In addition, the bank’s profits were impacted by increased regulatory costs and fines. The bank had to spend significant amounts of money on compliance and legal fees, which impacted its profitability.

Furthermore, the bank’s profits were impacted by the departure of key executives and the loss of customer confidence, leading to a decline in business and revenue.

Regulatory Issues

Less known and talked about Silicon Valley Bank faced several regulatory issues that contributed to its collapse. The bank was under investigation by the Securities and Exchange Commission (SEC) for its handling of a failed Initial Public Offering (IPO). Additionally, the bank was accused of violating anti-money laundering laws.

Furthermore, the bank’s compliance department was understaffed and struggled to keep up with regulatory changes. SVB’s leadership failed to invest in compliance and risk management, which led to significant fines and legal expenses.

Competition

Silicon Valley Bank faced intense competition from other banks and financial institutions. The emergence of fintech startups and online lenders disrupted the traditional banking industry, making it more challenging for SVB to compete. Additionally, established banks such as JPMorgan Chase and Wells Fargo began to focus on the technology industry, encroaching on SVB’s territory.

Furthermore, SVB’s lack of diversification made it vulnerable to competition. The bank relied heavily on the technology industry and had limited exposure to other sectors, such as healthcare and energy.

Customer Losses

The collapse of several high-profile startups and tech companies led to significant losses for SVB. The bank had a large portfolio of loans to startups and tech companies, and the failure of these firms led to a decline in the bank’s loan portfolio.

Additionally, the bank’s reputation was damaged by the failure of these startups. SVB was seen as a bank that specialized in financing startups and tech companies, and the failure of these firms eroded the bank’s credibility.

Poor Capitalization

SVB’s capitalization was a significant issue that contributed to its downfall. The bank’s leadership failed to raise enough capital to support its lending activities, leading to a decline in the bank’s financial health.

Additionally, the bank’s investment in risky assets such as cryptocurrencies led to significant losses, further eroding the bank’s capitalization.

Lack of Innovation

In the early years, Silicon Valley Bank led innovative and creative financing methods to reduce their risk while making loans to a risky and underserved market in startups.

SVB itself failed to innovate and keep up with emerging trends in the financial industry. The bank’s IT infrastructure was outdated, and the management failed to invest in upgrading it. Additionally, SVB failed to embrace emerging technologies such as blockchain, which could have improved its operations and reduced costs.

Furthermore, the bank’s lending practices were outdated, and it failed to adapt to changing customer needs. The emergence of fintech startups and online lenders disrupted the traditional banking industry, and SVB failed to keep up.

Lack of Transparency

SVB’s lack of transparency was a significant issue that contributed to its downfall. The bank’s leadership failed to provide clear and concise information about its financial health, leading to uncertainty among investors and customers.

In fact, the bank messaging to customers did little to stem the run on the bank and perhaps even contributed to the run on SVB.

Additionally, the bank’s compliance department was understaffed and struggled to keep up with regulatory changes. This lack of transparency led to significant fines and legal expenses.

Employee Turnover

Silicon Valley Bank’s toxic work culture led to high employee turnover, which contributed to the bank’s downfall. The bank’s leadership failed to address issues such as discrimination and harassment, leading to low morale among employees.

Furthermore, the bank’s compensation structure was not competitive, leading to difficulty in attracting and retaining top talent. The high employee turnover led to a decline in the bank’s productivity and profitability.

The Bank Run

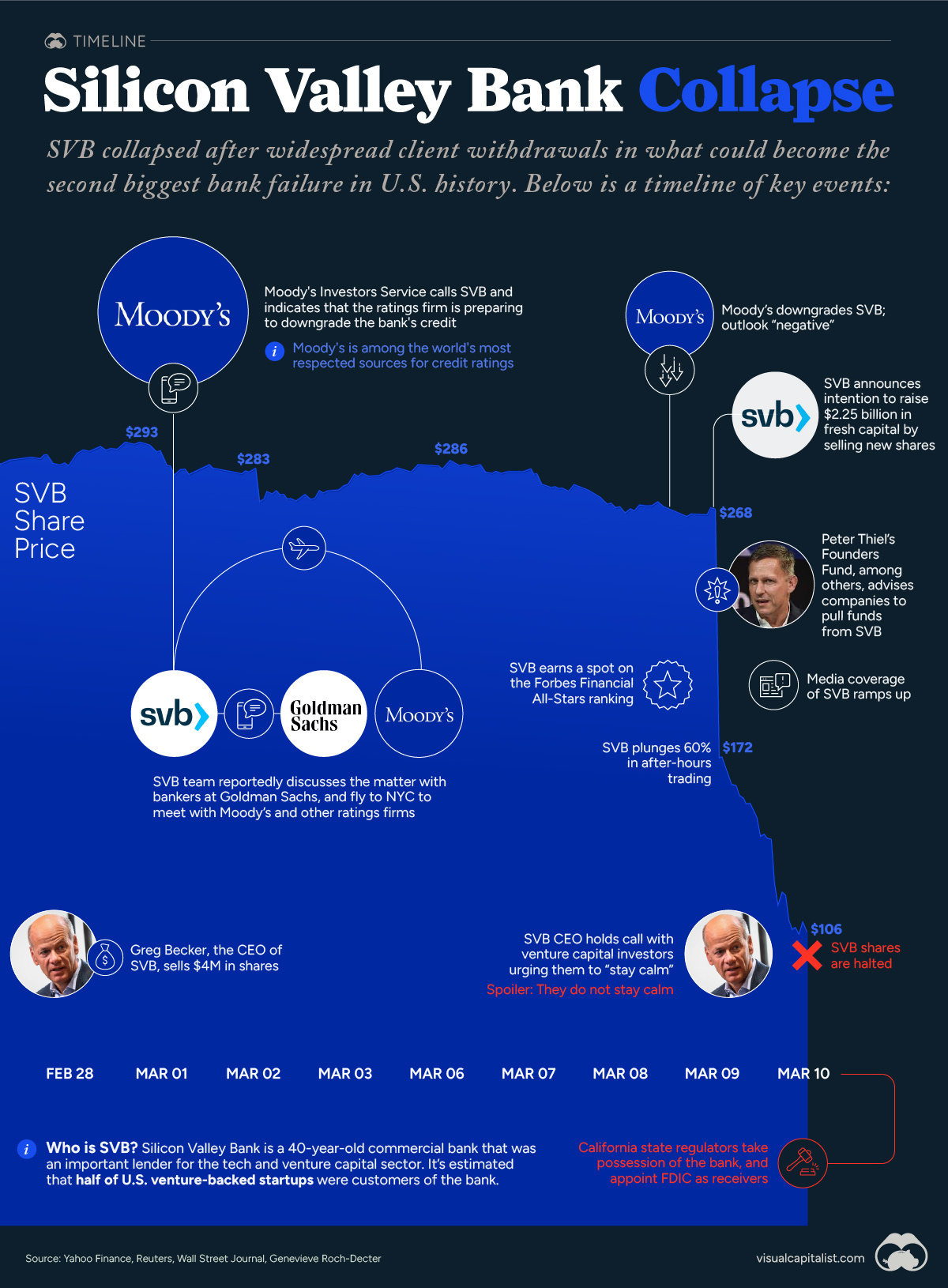

The Bank Run begins on SVB after the bank took a loss of $1.8 billion when they sold off US Treasuries and mortgage-backed securities. It was initiated after the CEO Greg Becker sent a letter to shareholders detailing the loss and the plan to raise $2.25 billion in capital. For a great timeline and more financial details on the SVB collapse, Visual Capitalist does a great job.

According to regulators customers immediately started pulling their money out of the bank. These customers included many of the venture capital firms and their clients.

Problems With Money Transfers

One of the key events leading to the Run on SVB was connected to Peter Thiel’s Founders Fund. During a “Capital Call” where it had asked investment partners to send funds to invest in a company by transferring funds to their own Silicon Valley Bank account. The funds failed to immediately go through as normally expected. Thiel took action withdrawing all its funds from SVB and by Thursday morning the fund no longer had cash in SVB.

Calls to Get Cash Out

Numerous other VC funds including Founders Fund, Union Square Venters, and Coatue Management advised companies in their portfolios to pull money out of SVB. See the Video from CNBC – VCs Call for Run on SVB.

There were calls for not pulling cash out, but by Thursday the damage was done. In a single day, SVB customers pulled $42 billion from the bank cementing the collapse and demise of SVB.

The Role of Technology in the Collapse

The irony of our advanced technological era is its exacerbation of the speed and efficiency of spreading the word of the potential failure and ability to withdraw or transfer funds quickly.

As VCs and their clients shared news of the collapse and call for pulling money out of SVB through Twitter and Slack channels word spread fast. Dubbed the “first Twitter bank run” word spread as did the rumors that created bank runs in the past, only much faster thanks to technology.

As with bank runs of the past, it became a self-fulfilling prophecy.

What Can You Do?

To prevent the loss of capital it is important to diversify. First, diversify in a way that you can utilize multiple accounts within the same financial institution or bank trying to keep accounts to the FDIC Coverage.

Next, diversify across multiple banks and financial institutions to lessen the impact. There are some little-known ways to increase your FDIC coverage by utilizing special methods and accounts while remaining liquid.

If you’re concerned about the impact and fallout of the collapse of Silicon Valley Bank and how that could impact your business schedule a call with us to complete a Financial Impact Analysis.

Conclusion

The collapse of Silicon Valley Bank was the result of multiple factors, including internal mismanagement, economic factors, regulatory issues, competition, customer losses, poor capitalization, lack of innovation, lack of transparency, and employee turnover. The bank’s leadership failed to address these issues, leading to a decline in the bank’s financial health.

SVB’s collapse serves as a cautionary tale for other banks and financial institutions. It highlights the importance of effective risk management, diversification, innovation, transparency, and positive work culture. Banks must continuously adapt to changing market conditions and customer needs to remain competitive and profitable.